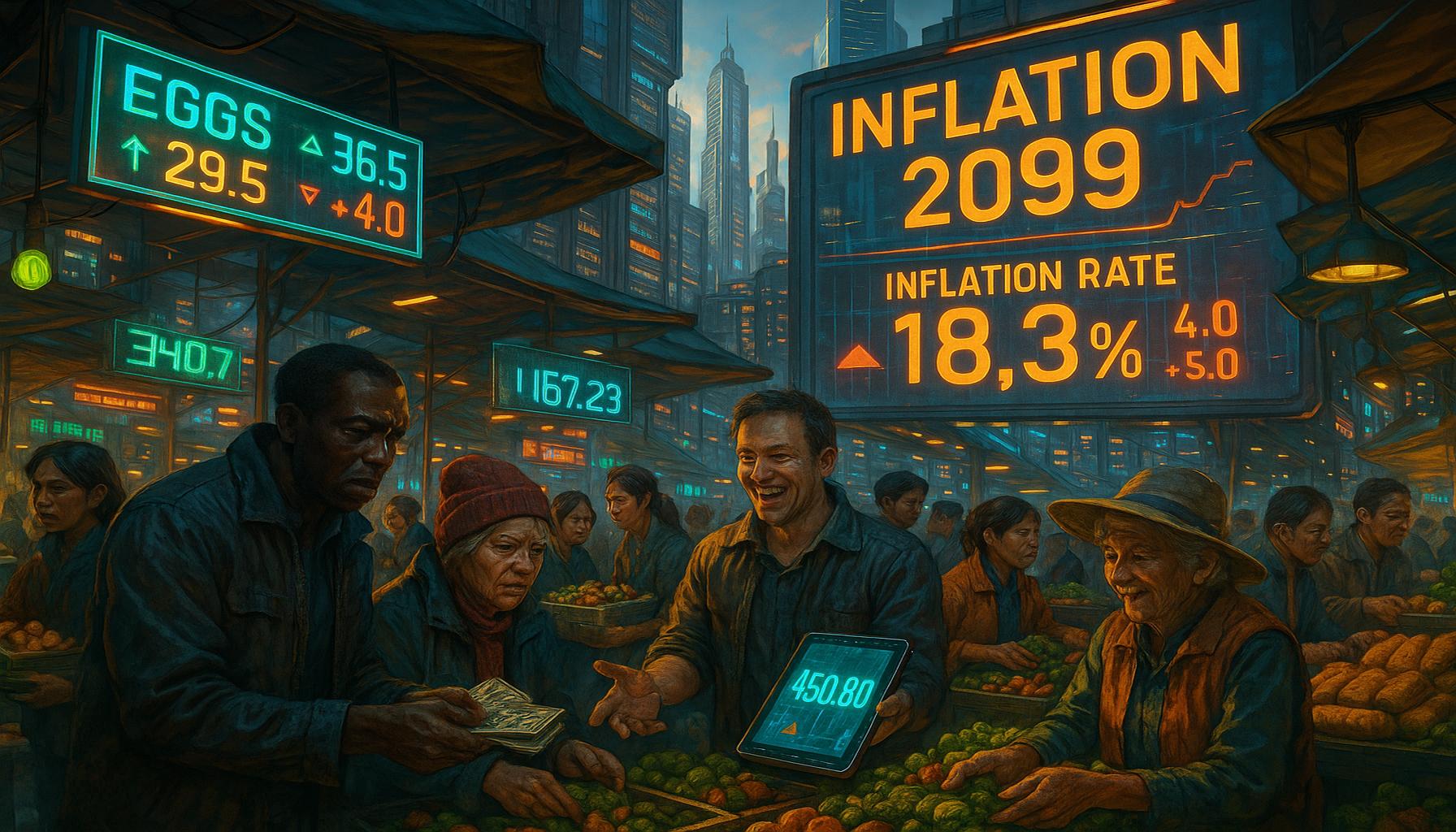

The impact of inflation in 2099: forecasts and realities

Understanding Inflation and Its Future Impact

The phenomenon of inflation is a critical factor in the economic landscape, deeply influencing purchasing power, investment decisions, and overall economic health. With a thorough examination of historical inflation trends, economic policies of the past, and responses from diverse markets, we can glean essential insights that will shape our understanding of future scenarios by the year 2099. This analysis serves as a pivotal resource for individuals, businesses, and policymakers as they navigate the complexities of an evolving economic environment.

Government monetary policies play a fundamental role in shaping inflation rates. Interest rate adjustments by the Federal Reserve are often the first line of defense against rising inflation. For instance, if inflation were to spike due to increased consumer spending, the Fed may raise interest rates to temper that growth by making borrowing more expensive. Similarly, currency control mechanisms, such as controlling the money supply, are implemented to keep inflation in check. Fiscal measures, such as government tax policies and public spending, also directly influence inflation by affecting aggregate demand within the economy.

Moreover, global supply chains the world over are increasingly vulnerable to disruptions—be it from climate change, global health crises like pandemics, or escalating geopolitical tensions. For example, the COVID-19 pandemic highlighted how quickly supply chains can be disrupted, leading to shortages that drive prices up. As globalization continues to intertwine economies, events in one region can have rippling effects on inflation worldwide, further complicating efforts to stabilize prices.

Technological advancements offer a dual edge when it comes to inflation. While innovations such as automation may enhance productivity and reduce costs, thus leading to deflationary trends, they can also introduce new industries and markets that may swell demand, exerting upward pressure on prices. With the advent of artificial intelligence, machine learning, and renewable energy technologies, the balance between supply efficiency and increasing demand will likely dictate inflationary pressures.

Potential Scenarios for Inflation in 2099

Looking ahead, several scenarios could materialize concerning inflation by the year 2099:

- Hyperinflation scenarios could emerge if monetary expansion goes unchecked. Historical examples, such as Zimbabwe in the late 2000s, remind us how quickly hyperinflation can decimate savings and erode purchasing power.

- Deflationary trends may arise as technological efficiencies become the norm and consumer demand decreases, particularly as younger generations prioritize sustainability and minimalism. As seen in Japan’s prolonged period of deflation, such a scenario could challenge economic growth.

- Stagflation risks—a combination of stagnation and inflation—could prove particularly troublesome. The 1970s in the United States provides a historical reference, as rising oil prices coupled with stagnant economic growth created a challenging environment for policymakers.

The potential consequences of these inflationary scenarios extend beyond individual financial planning. They can significantly affect overall economic stability, labor markets, and government policies. Understanding and preparing for these varying inflationary pressures will be crucial for navigating the intricate web of challenges posed by future economic landscapes. As we move closer to 2099, proactive adaptation strategies within fiscal and monetary frameworks will become increasingly necessary to mitigate the adverse impacts while seizing opportunities that arise from change.

DISCOVER MORE: Click here to learn how to apply easily

Inflation Trends: Historical Context and Future Implications

To forecast the impacts of inflation by 2099, it is essential to understand its historical context and how economic forces have influenced inflationary trends over the decades. Economic indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI) have painted a vivid picture of inflationary behavior in the United States. For instance, the annual inflation rate saw a dramatic increase during the 1970s, largely due to oil embargoes and escalating production costs. This historical period serves as a pertinent cautionary tale regarding the potential for future inflationary spikes if economic policies fail to adapt to changing variables.

A significant concern for the future is monetary policy alignment with evolving economic realities. Current trends indicate a shift toward more accommodative monetary policies, characterized by low-interest rates and expansive fiscal measures. As seen in recent years following the COVID-19 pandemic, the United States has employed substantial quantities of quantitative easing (QE) to stimulate growth, potentially setting the stage for inflationary pressures if not carefully unwound. By 2099, patterns observed in past responses to crises may inform our understanding, raising critical questions about the sustainability of current monetary strategies.

Global factors further complicate the inflationary landscape. In a hyper-connected world, international trade agreements, natural disasters, and shifts in demographics can have profound impacts on local economies. Reports from the International Monetary Fund have demonstrated how supply chain disruptions can lead to localized shortages and price increases, echoing the experiences of many during the recent pandemic. Such disruptions highlight the interconnectedness of economies and the amplification of inflationary effects across borders. By 2099, a growing reliance on digital currencies and decentralized finance could also play a role in shaping how inflation is experienced globally, further straining traditional measures of economic stability.

Moreover, demographic shifts will likely influence inflation trends. The aging population in the U.S., coupled with the evolving preferences of younger consumers, is expected to shape market dynamics. Research conducted by the Pew Research Center indicates that younger generations prioritize sustainability and ethical consumption. This shift could lead to increased demand for eco-friendly products, potentially causing price hikes in these niches. As companies invest heavily in meeting ethical consumer demand, a scenario may arise where traditional price indexes underrepresent actual inflation experienced by consumers.

Key Factors Influencing Future Inflation

Several key factors will play a critical role in shaping inflation forecasts as we approach 2099:

- Policy Adjustments: Amendments to fiscal and monetary policies will have direct consequences on inflation rates, requiring adaptive strategies from policymakers.

- Technological Innovations: Advancements in technology could create both cost-reduction opportunities and new inflations through emergent sectors, impacting aggregate demand.

- Climate Change Pressures: Environmental issues may result in higher production costs and create supply chain vulnerabilities that can drive up prices.

- Labor Market Trends: Shifts in labor market dynamics and wage pressures will also be significant factors influencing inflationary trends in the coming decades.

As these factors interweave, understanding their potential trajectory will be crucial for financial planning, investment strategies, and policy formulation. The importance of preparing for a range of inflationary outcomes cannot be overstated, as the implications for consumers and the economy at large are profound. By considering both historical lessons and emerging trends, stakeholders can navigate the complexities of future economic landscapes with greater confidence.

DIVE DEEPER: Click here to uncover the impact of social media on stock trading</

Navigating the Inflationary Landscape: Scenarios and Strategies

As we project into the future of inflation by 2099, it becomes essential to explore how various economic scenarios could unfold in response to the key factors previously identified. Understanding these scenarios will help stakeholders make informed decisions about their financial futures, investment approaches, and overall economic strategies.

Scenario Analysis: There are several potential scenarios that could shape inflation trends as we look ahead. One likely scenario is a moderate inflation environment, where monetary policies effectively balance growth and price stability. In this scenario, inflation could average around 2-3% annually, closely following the Federal Reserve’s target. With strategic fiscal measures, including targeted investments in infrastructure and renewable energy, consumer confidence may remain robust, thus supporting demand without triggering runaway price hikes.

In stark contrast, a stagflation scenario could emerge if economic growth stagnates while inflation accelerates. Historical precedents, such as the 1970s economic turmoil, underscore the risk associated with supply-side shocks, which could arise from geopolitical tensions, including trade wars or resource scarcity prompted by climate change. In this context, businesses may face rising labor costs and diminished consumer purchasing power, exacerbating the economic burden on households. Maintaining a focus on diversified investments and inflation-hedged assets will be key strategies for consumers navigating this landscape.

On the flip side, a deflationary period can also have significant implications. Such an occurrence, where prices consistently fall for an extended duration, could arise from technological advancements that drive down production costs significantly more than consumer prices can be adjusted upward. This scenario could lead to increased unemployment rates, as businesses struggle to maintain profitability in a deflationary cycle. For consumers, while lower prices might seem beneficial initially, prolonged deflation can result in reduced demand, constrained spending, and, ultimately, an economic slowdown. In such a scenario, holding cash or cash equivalents might be an unfavorable strategy, as it loses value over time; alternatively, investing in bonds or dividend-paying stocks could offer more resilient returns.

Inflation Hedging Strategies

As inflation forecasts vary across scenarios, individuals and businesses alike will need to adopt robust strategies tailored to inflationary environments. Here are some potential approaches to consider:

- Real Assets Investment: Investing in real assets such as real estate, commodities, and precious metals may provide a buffer against inflation. Historically, these assets have maintained or even appreciated value during inflationary periods.

- Inflation-Linked Bonds: Instruments such as Treasury Inflation-Protected Securities (TIPS) directly link returns to inflation, providing a safeguard against rising prices.

- Flexible Wage Strategies: Employers may consider flexible wage strategies to adjust compensation in line with inflation, ensuring that purchasing power is preserved while maintaining workforce satisfaction.

- Global Diversification: Expanding investments internationally can mitigate risks associated with localized inflation. Diverse currency exposure and different economic environments can provide a cushion against domestic inflation fluctuations.

These strategic options serve to enhance resilience against a myriad of inflation scenarios that could emerge by 2099. Stakeholders must be vigilant, understanding that economic landscapes are constantly evolving, and remaining interconnected with global trends is essential for informed planning and investment.

DISCOVER MORE: Click here to learn about the rise of financial regulation

Conclusion: A Future of Uncertainty and Preparedness

As we evaluate the potential trajectories of inflation leading into 2099, it becomes evident that the economic landscape is fraught with both opportunities and challenges. The forecasts presented illustrate diverse scenarios—from moderate inflation environments that could foster growth and stability, to the specter of stagflation that threatens to squeeze consumer purchasing power and economic vitality. Additionally, the possibility of a deflationary cycle reminds us that economic conditions can be unpredictable and multifaceted.

In light of these varied futures, strategic foresight is essential. Individuals and businesses must actively cultivate resilient investment strategies that can withstand inflationary pressures, as well as positioning themselves to take advantage of the stability offered by real assets and inflation-linked instruments. As inflation forecasts become more nuanced, adapting flexible wage strategies can help protect employee morale and spending power.

Furthermore, global diversification remains a pivotal tactic in mitigating localized inflation risks, emphasizing the importance of keeping a pulse on worldwide economic trends. By remaining agile and informed, stakeholders can enhance their ability to navigate the complexities of inflation through effective planning.

Ultimately, the economic realities of 2099 will hinge upon collective responses to the evolving challenges of inflation. By harnessing a combination of innovation, strategic investment, and adaptability, stakeholders can foster a more resilient economy that safeguards against the unpredictable tides of inflationary pressures in the decades to come.

Related posts:

The Gig Economy and Participation in the Stock Market: Trends among Freelancers and Side Jobs

How changes in interest rates affect small businesses

The Future of Digital Currencies: Central Bank Digital Currencies (CBDCs)

Consumer Trends in 2099: What Financial Data Reveals

The Future of Information Technology and Its Implications for American Society

The challenges of entrepreneurship in today's digital market

Linda Carter is a writer and financial expert specializing in personal finance and investments. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Curiosidade Atual platform. Her goal is to provide readers with practical advice and strategies for financial success and smart investments.