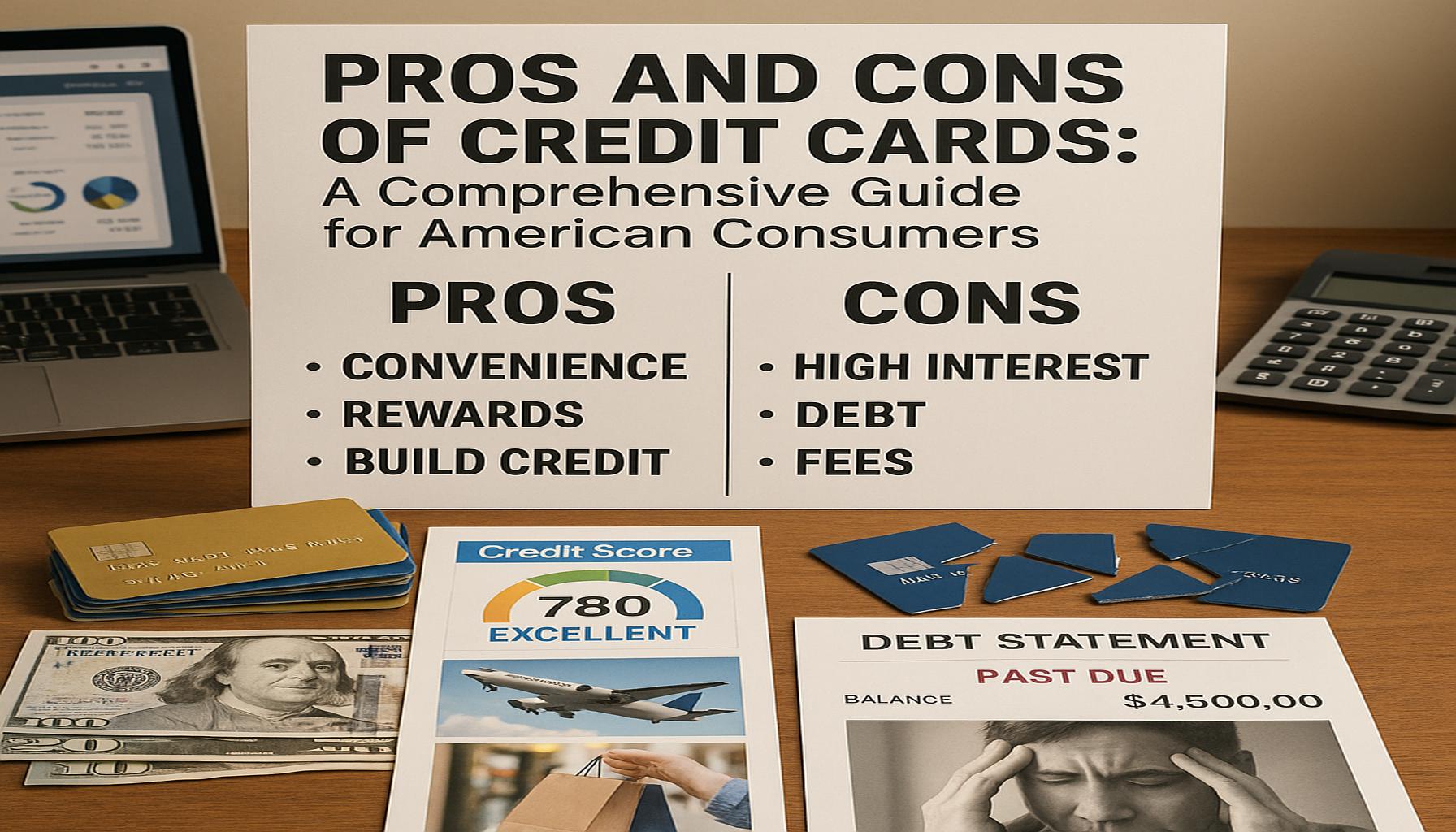

The Pros and Cons of Credit Cards: A Complete Guide for American Consumers

Understanding Credit Cards

Credit cards have become a fundamental aspect of personal finance in the United States. With their increasing prevalence, it is vital for consumers to comprehend both the benefits and potential pitfalls of using them. This guide aims to provide a balanced view of the factors that influence credit card usage.

Advantages of Credit Cards

- Convenience: Credit cards offer unparalleled convenience for everyday purchases. Whether shopping online or in physical stores, consumers can complete transactions quickly without the need to carry cash. For example, with a simple swipe or tap, users can purchase groceries, pay for gas, or book travel arrangements, often at any time of day.

- Rewards Programs: Many credit cards come with lucrative rewards programs. Depending on the card, consumers can earn points, cash back, or travel miles on their purchases. For instance, a card that offers 2% cash back on all purchases can translate into significant savings for someone who spends $2,000 per month, totaling $480 in cash back annually. Additionally, travel-related credit cards often provide perks like complimentary hotel stays or access to airport lounges, making them appealing for frequent travelers.

- Building Credit History: Responsible credit card usage is a key factor in establishing and maintaining a strong credit history. Making timely payments and utilizing only a small portion of the available credit can boost one’s credit score. This, in turn, can lead to better interest rates for loans and other financial products in the future. For instance, securing a mortgage with a high credit score can save thousands in interest payments over the life of the loan.

Disadvantages of Credit Cards

- Debt Accumulation: While credit cards provide immediate purchasing power, they also pose a risk of debt accumulation. High-interest rates, combined with the temptation to spend beyond one’s means, can lead to substantial debt if balances are not paid in full each month. The average credit card interest rate in the U.S. can exceed 15%, resulting in an escalating financial burden for consumers who carry a balance.

- Fees: Credit cards can come with several fees that add to the overall cost of borrowing. Annual fees, late payment charges, and foreign transaction fees can quickly diminish the benefits associated with reward programs. For example, a card with a $95 annual fee may sound attractive due to its benefits, but if the user cannot fully leverage those rewards or overspends, it may not be worth the cost.

- Impact on Credit Score: The manner in which credit cards are managed can significantly impact one’s credit score. Missed payments or exceeding credit limits can lead to severe penalties, harming a consumer’s creditworthiness. A low credit score can make it challenging to secure loans or mortgages in the future, often resulting in higher interest rates or outright rejections from lenders.

As American consumers navigate the landscape of credit, awareness of both sides is crucial. Understanding the pros and cons of credit cards can aid in making informed decisions that align with one’s financial goals. This guide will delve deeper into these considerations, enabling readers to optimize their credit card use while minimizing risks.

In conclusion, a thorough grasp of credit card dynamics equips consumers with the necessary tools to leverage their benefits while remaining vigilant against potential pitfalls. By exercising self-discipline, utilizing rewards strategically, and maintaining a solid credit history, individuals can harness the power of credit cards to enhance their overall financial health.

SEE ALSO: Click here to read another article

Credit Card Utilization: Weighing the Benefits and Drawbacks

As American consumers increasingly turn to credit cards for their everyday financial transactions, understanding their advantages and disadvantages becomes paramount. The landscape of credit card use is complex, and a thorough analysis can assist consumers in making decisions that positively impact their personal finances.

Maximizing Credit Card Benefits

To fully leverage the advantages of credit cards, consumers should adopt proactive strategies that align with their financial habits and goals. Here are some key practices that can optimize credit card use:

- Timely Payments: Consistently making payments on time is crucial not only to avoid late fees but also to maintain a positive credit score. Setting up automatic payments or reminders can mitigate the risk of forgetting due dates.

- Budgeting Wisely: Establishing a budget that incorporates credit card spending can help manage expenses and prevent overspending. By allocating a specific amount for credit card charges each month, consumers can enjoy the flexibility of credit without falling into debt.

- Understanding Terms: Familiarity with the card’s interest rates, fees, and rewards programs ensures that consumers can make informed choices. For example, certain cards might offer introductory periods with 0% APR on purchases, allowing consumers to make larger transactions without accruing immediate interest.

Risks Associated with Credit Card Use

While credit cards offer numerous benefits, they also carry inherent risks that can lead to financial strain if not managed effectively. Recognizing these risks is essential for informed financial decision-making:

- Impulse Buying: The ease of swiping a credit card can facilitate impulsive purchases, often leading consumers to spend more than they initially intended. It is essential to differentiate between needs and wants when using credit to avoid regretful purchases.

- Rising Balances: Without a structured repayment plan, credit card balances can quickly escalate due to high-interest rates. Consumers should strive to pay off their balances in full each month to avoid incurring additional charges and prolonging debt.

- Identity Theft and Fraud: Credit cards can be susceptible to security breaches, leading to unauthorized transactions. It is imperative for consumers to monitor their accounts regularly for suspicious activity and report any discrepancies to their card issuer immediately.

Ultimately, a balanced understanding of both the benefits and risks associated with credit cards empowers consumers to utilize them effectively. By implementing sound financial practices and remaining vigilant against potential pitfalls, American consumers can enhance their financial experience through responsible credit card management.

CHECK OUT: Click here to explore more

Navigating Credit Card Features: Options and Considerations

In addition to understanding the fundamental benefits and drawbacks of credit card usage, American consumers must also navigate the myriad features and options offered by credit card issuers. Credit cards come with a diverse array of features designed to cater to different spending habits, lifestyle choices, and individual financial goals. To make the most informed decisions, consumers should consider the following key aspects:

Rewards Programs

Many credit cards offer rewards programs that incentivize cardholders for spending. These rewards may take various forms, including cash back, points redeemable for merchandise or travel, and airline miles. It is essential for consumers to evaluate their spending patterns to identify which rewards program aligns best with their lifestyle. For example, frequent travelers may benefit significantly from travel reward cards that offer perks such as free airline tickets or hotel upgrades. However, consumers should also be wary of cards that have high annual fees that may outweigh the benefits of the rewards earned.

Introductory Offers and Balance Transfers

Another appealing feature of credit cards is the availability of introductory offers, which can include 0% APR on purchases or balance transfers for a limited period. For consumers looking to make a significant purchase or transfer existing debts, these offers can serve as powerful financial tools. However, it is crucial to consider the duration of the offer and the standard interest rate that will apply once the introductory period ends. A careful examination of the terms and potential fees involved in a balance transfer is also advisable, as it can lead to long-term savings if managed correctly.

Building Credit History

For many Americans, using a credit card effectively is one of the most impactful strategies for building a strong credit history. Having a credit card and utilizing it responsibly can contribute positively to an individual’s credit score, particularly when payments are made on time and balances are kept low compared to the available credit limit. This improved creditworthiness can translate into lower loan interest rates and better terms for future financial products, such as mortgages or auto loans. However, it is vital for consumers to recognize that accumulating debt without a plan for repayment can do the opposite, damaging their credit score and financial health.

Additional Fees and Costs

In addition to interest rates, credit cards may come with a variety of additional fees that can catch unsuspecting consumers off guard. Common fees include annual fees, foreign transaction fees, late payment fees, and cash advance fees. Understanding the full cost of maintaining a credit card is essential before applying or using it. Selecting a card that minimizes these fees can significantly affect overall savings and enhance the value derived from credit card use.

Ultimately, the decision to use a credit card should reflect a holistic view of an individual’s financial situation, spending habits, and future goals. By thoroughly evaluating the diverse features offered by credit cards and assessing their potential impact, consumers can make informed choices that align with their long-term financial strategies.

SEE ALSO: Click here to read another article

Conclusion

In conclusion, the utilization of credit cards presents a complex landscape that offers both significant benefits and notable challenges for American consumers. On one hand, credit cards provide a valuable avenue for building credit history, which is essential for obtaining loans for major purchases such as homes and vehicles. By using credit cards responsibly, consumers can enhance their credit scores, as timely payments and low credit utilization ratios contribute positively to their credit profiles. Additionally, many credit card companies offer a range of convenient financing options, allowing users to finance purchases without immediate cash outlays. This can be particularly advantageous for consumers facing unforeseen expenses or making large purchases, as they can pay off their balance over time rather than depleting their savings.

Moreover, the allure of rewards programs cannot be overlooked. From cash back on groceries to points redeemable for travel, many cards cater to specific spending habits, enabling cardholders to benefit from their everyday expenditures. For example, a consumer who frequently travels might choose a card offering airline miles, leading to discounted flights or hotel stays. When used wisely, credit cards can thus facilitate financial growth and encourage responsible spending through their various incentives.

Conversely, consumers must navigate the pitfalls associated with credit card use, including the potential for high-interest debt accumulation, which can occur if balances are not paid in full each month. The average credit card interest rate in the United States hovers around 16% to 24%, making it imperative for consumers to understand their credit agreements and avoid unnecessary charges. Additionally, late payment fees and annual fees can further complicate financial management, putting a strain on budgets. The risk of damaging one’s credit score through irresponsible behavior, such as missed payments or maxing out credit limits, adds another layer of complexity to credit card use.

As American consumers consider their financial options, it is imperative to approach credit card usage with a clear understanding of their personal financial goals, spending patterns, and the specific terms associated with the cards they choose. This includes examining interest rates, fees, and rewards structures, as well as assessing one’s ability to manage payments responsibly. Ultimately, informed decision-making is critical. By thoroughly researching different credit card products and considering how they would fit into their broader financial strategy, consumers can mitigate risks while harnessing the potential benefits of credit cards.

For many, the responsible management of credit can translate into improved financial opportunities and stability over time, making it a crucial aspect of modern financial health. A well-managed credit card can serve as a powerful tool in building a robust financial future, provided that individuals remain vigilant and proactive in their credit management practices.

Related posts:

How to Apply for ANZ Rewards Black Credit Card?

Benefits of Premium Credit Cards Offered in Australia

How to Apply for the American Express Platinum Credit Card?

How to Apply for the St. George Amplify Rewards Signature Credit Card?

How to Apply for the American Express Essential Credit Card?

Credit cards for students: how to build credit from early on

Linda Carter is a writer and financial expert specializing in personal finance and investments. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Curiosidade Atual platform. Her goal is to provide readers with practical advice and strategies for financial success and smart investments.