Blockchain and its Influence on the Transparency of Financial Transactions

Blockchain technology is revolutionizing financial transactions by enhancing transparency and accountability. Its immutable records, decentralization, and public accessibility foster trust among stakeholders while reducing fraud. Real-world applications, from banking to non-profits, demonstrate its potential to secure financial integrity and streamline processes, reshaping the future of finance.

The Role of Technology in the Transformation of Traditional Investments

Technology is revolutionizing traditional investments by enhancing accessibility, lowering costs, and increasing efficiency. Innovations like algorithmic trading, robo-advisors, and big data analytics democratize financial strategies and empower investors, paving the way for alternative assets and improved decision-making in an evolving market landscape.

The Role of Cybersecurity in Protecting Financial Data

In a digital age, effective cybersecurity is vital for financial institutions to protect sensitive data from cyber threats like data breaches and ransomware attacks. Strong strategies, including compliance with regulations and robust risk management, foster consumer trust while safeguarding the financial system against evolving risks and maintaining organizational integrity.

The Importance of Diversification in Investment Portfolios

Diversification is crucial for successful investment portfolios, balancing risk and potential growth by spreading assets across various classes, sectors, and geographic regions. Understanding individual risk tolerance and setting clear investment goals further enhances strategy effectiveness, ensuring resilience against market volatility while optimizing returns. Regular portfolio review and rebalancing are essential for long-term financial success.

Fintechs and the Digital Revolution in Access to Banking Services

The emergence of fintech companies is transforming traditional banking by enhancing accessibility, cost efficiency, and user experience. Leveraging technologies like mobile apps and blockchain, fintechs foster financial inclusion, streamline operations, and create opportunities for underserved communities, while navigating regulatory challenges and market competition. The future of banking is digital and inclusive.

Investing in Cryptocurrencies: Risks and Opportunities in a Volatile Market

Cryptocurrencies present both risks and opportunities in a volatile market. Understanding market dynamics, regulatory changes, and technological advancements is crucial for effective investment. Diversifying portfolios and assessing personal risk tolerance can help investors navigate price fluctuations and make informed decisions in this rapidly evolving digital asset landscape.

How Data Analysis is Transforming Investment Strategies

Data analysis is revolutionizing investment strategies by enhancing risk management, enabling informed decisions, and facilitating personalized portfolio customization. Advanced analytics and algorithmic trading empower investors to navigate complex markets, anticipate trends, and optimize outcomes, leading to more effective financial planning and stronger investor-advisor relationships.

Financial Planning for Freelancers: How to Manage Irregular Income

Freelancers face unique financial challenges due to irregular income, making effective financial planning crucial. By establishing a flexible budget, building an emergency fund, diversifying income streams, and utilizing financial tools, freelancers can mitigate uncertainties and create a stable financial foundation for long-term success.

The Impact of Artificial Intelligence on Credit Risk Assessment

Artificial intelligence is transforming credit risk assessment by enhancing data analysis, improving speed and accuracy, and facilitating personalized lending options. By leveraging diverse data sources and predictive analytics, AI enables lenders to make more informed decisions, reduce fraud, and promote financial inclusion, ultimately creating a more equitable lending landscape.

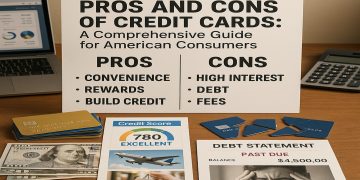

The Pros and Cons of Credit Cards: A Complete Guide for American Consumers

This comprehensive guide explores the advantages and disadvantages of credit cards for American consumers. It highlights the convenience and rewards benefits while addressing risks such as debt accumulation and fees. Understanding credit card features is essential for making informed financial decisions and optimizing usage for better financial health.